1. Introduction

Since the official introduction in March 1st 2018, $PAC has hit the crypto market with a bang. The hype surrounding the coin on popular crypto exchanges has not gone unnoticed by the followers of this market. Even though much of the popular discussion focuses on the short term perspectives and performance of $PAC, the ‘big picture’ potential role of $PAC is much broader than just the trade exchanges.

The purpose of this article is:

(1) To provide a basic outline of the evolution of money as an instrument to facilitate trade

(2) To delineate the relative position of $PAC with regards to alternative moneys and thereby highlighting why this particular digital coin is so attractive in the world of cryptocurrency.

Before digressing into the details of digital currency, distributed ledger technology and the complex algorithms behind it, it is important to be able to articulate what money is.

Money can be defined as a generally accepted and trusted means of exchange that facilitates trade and transactions between parties.

2. The evolution of money

2.1. Hunter-gather communities

In the beginning, humanity was organized in small, tribal communities of hunter-gatherers with tightly knit family ties between the members. Most of the resources are communally obtained and shared between members without much need to keep track of transactions.

Figure 1. A modern day interpretation of the functionality of hunter-gather communities (artist: Victor Ambrus)

2.2. Surplus production and trade

Gradually humanity adopts agriculture, specialization of skills & division of labor, leading to surplus production. Things are going so well that there is enough surplus to take these items to the market (e.g. going to a nearby tribe and try to trade the products for items that you find more useful for yourself).

Thusly, we can already recognize there is no such thing as a ‘real price’. The only thing we can conclude from a given transaction price is that the person selling a particular item values that item as less than what he/she is getting in return for it as a result of the trade and conversely, that the person who acquires that particular item, values that item as being of higher value than whatever they have traded the item for. Consequently, price always has a multidimensional component and is not a fixed element.

Figure 2: A depiction of early forms of trade

2.3. The requirement for divisible and portable means of exchange

Exchanging surplus production on a market is not always as easy as it sounds. After all, if one is a cattle owner, it is important to be able to engage in (micro) economic transactions without every time having to slaughter a cow and offer a fraction of the cow as a means of exchange to engage in trade. In addition, not every trader will be interest in cows. Taking into account other pragmatic factors such as the need to travel with assets (portability), as a result, communities around the world converge to the adoption of the concept of deploying specific items in circulation to facilitate trade.

This process eventually leads to certain items that are found by the general community as useful to be used as a general and trusted means of exchange (portable power). In popular history this is often gold, but in other scenarios such as is the case in modern prisons, money can also be embodied through phone cards or cigarettes; even non-smokers in prison might use cigarettes as an instrument of trade to acquire desired products and/or services.

It is important to understand that one thing that all forms of money invariably have in common is a wide-spread shared faith/trust in the intrinsic value of the means of exchange at hand by those using it as an instrument to facilitate trade. Moreover, money obviously becomes more useful when it is easy to divide like gold or a pack of cigarettes. Although gold and silver are often considered to have an intrinsic value, the historical cases of Mansa Musa and also the case of the Spanish price revolution suggests otherwise.

Figure 3: The extravagant scale of the pilgrimage of 14th century African King Mansa Musa – considered by many to be the richest person in history- destabilized the regional economy as the result of his generous gold expenditure, consequently reducing the value of gold.

2.4. The recording of trade transactions (ledgers)

As the volume of trade transactions increases, thus does the need to record transactions. In this context we can observe all kinds of recording devices across the world. The one that we are most familiar with is writing, but other devices such as the ‘Quipu’ have also served similar purposes.

Figure 4. The ‘Quipu’, a data recording device consisting of tying knots in ropes used by the Inca’s. The composition of knots on different ropes, combined with deciphering algorithms as shown in the matrix in the lower left corner, results in a practical recording device.

2.5. The use of a trusted third party to record transactions between two parties

In the modern context humans arrange their significant affairs through legalities (e.g. a notary), however in ancient times, we can already discern customs of the use of a third party to record and codify transactions between two parties. The oldest known recording of a customer complaint originates from Babylon and dates from 1750 BC. In this complaint directed to the merchant Ea-nasir, Nanni (the complainer) states the following in Cuneiform writing: “Is there anyone among the merchants who trade with Telmun who has treated me in this way? You alone treat my messenger with contempt! On account of that one (trifling) mina of silver which I owe(?) you, you feel free to speak in such a way, while I have given to the palace on your behalf 1,080 pounds of copper, and umi-abum has likewise given 1,080 pounds of copper, apart from what we both have had written on a sealed tablet to be kept in the temple of Samas.”

In the aforementioned case, the temple of Samas can thus be considered to have assumed the role of a trusted third party and a reliable witness to the transactions at hand. This party controls for two persistent problems that form the bulk of activities and infrastructure behind modern banking, namely: ‘the verification of the possession of assets’ and ‘to control for double spending’.

Figure 5: A tablet in Cuneiform script, similar to the one used by Nanni to record his complaint.

2.6. The use of letters of promise

The next phase revolves around the role of middlemen, banks and letters of promise to pay, popularly known in the crypto community as fiat currency. These are middlemen that hold a great deal of assets. In many cases castles, banks or goldsmiths, would maintain the generally accepted means of exchange.

Since for many people it was and is too dangerous to hold and/or travel around with monetary gold, they would, reasonably, rather walk around with a paper/promissory note and exchange that note for gold later.

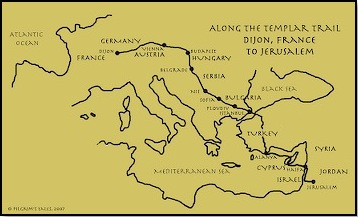

An often cited example in this regard is the role of the Knights of Templar in the issuing of personalized ‘letters of credit’ for pilgrims during the crusades. As a matter of fact, in turbulent mediaeval times, individuals might be eager to voluntarily leave their valuables in castles such as those of the Knights of Templar for safekeeping.

Thusly, next to the function of ‘the verification of the possession of assets’ and ‘to control for double spending’, banks also assume the role as ‘safeguards of valuable assets (store of value)’, such as gold and jewelry.

Figure 6: During the crusades, pilgrims would travel along the ‘Templar Trail’ with letters of credit redeemable at the next ‘castle’. Source: (Brandon Wilson, 2008, Along the Templar Trail).

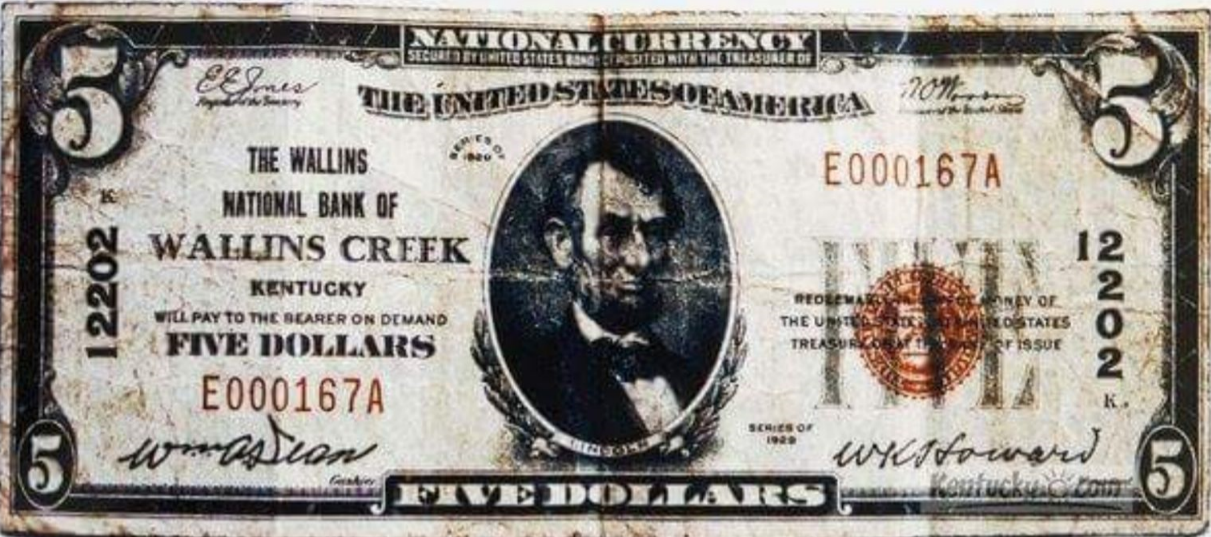

Figure 7: A promise to pay to the ‘bearer’ on demand five dollars. Note how the money issued by a private bank and not by the federal reserve.

Note that with the advent of letters of promise, the practice of ambitiously issuing more letters of promise than one can actually cover in terms assets comes into play (because of e.g. assumed delay between withdrawals). This is called ‘fractional reserve banking’, and its most feared enemy is the ‘bank run’.

2.7. Central banks controlled by the financial elite

The issuing of letters of promise in most countries around the world has gradually become a semi-public affair. The aforementioned has led to the creation of central banks around the world with the façade of being a public institution, but in reality controlled by the financial elite (see: ‘Secrets of the Federal Reserve’ by Eustace Mullins (1952, version 2: 1983); and ‘Tragedy & Hope: A History of the World in Our Time’ by Carrol Quigley, (1966)). These parties currently issue the so called ‘fiat currency’.

An interesting side note is that most wars over the past centuries have been financed through (bearer) bonds issued by the same financial elite. For example, the founder of the Federal Reserve system in 1913, German-born banker Paul Warburg, was the brother of the apex of the German financial system, head of the German secret service and also advisor to the German Emperor, Max Warburg. In addition, their brother in law, Jacob Schiff, notoriously exerted undue influence on Russian politics. This same financial elite has stimulated nations into entering world war one, two and three (world war three is ongoing since September 11th, 2001 and entails Christians and Muslims being pitted against one and another in long-term hostility).

When confronted with the question of stable value of fiat currency, consider for example the role of the ‘Quantum fund’ (a fund, located in Curacao, that is mutually owned by the Rothschild family and George Soros), in the 1992 Black Wednesday England crisis. This fund played a crucial role in ‘the breaking of the English pound’ and indicates how the international financial elite can manipulate the fiat currency market at will, as they have done so, and will continue in doing so.

2.8. Credit Union

“A credit union is a member-owned financial cooperative, controlled by its members and operated on the principle of people helping people, providing its members credit at competitive rates as well as other financial services. Credit unions differ from banks and other financial institutions in that those who have accounts in the credit union are its members and owners, and they elect their board of directors in a one-person-one-vote system regardless of their amount invested. Credit unions see themselves as different from mainstream banks, with a mission to be “community-oriented” and “serve people, not profit”.

The development of the credit union displays a naturally present desire of humans to accept and adopt clear benefits of modern financial services, but through a ‘by the people, for the people’ approach instead of total dependence of- and subservience to elite bankers.

3. The information age, internet and digital currency

Increasingly, there is a healthy skepticism towards the assumption that fiat currency serves as the only possible instrument to facilitate trade. Fiat currency as we know it currently entails an exclusive monopolistic privilege for the financial elite and functions as an undue source of geo-political influence control by international central bankers (Mullins, 1952; 1983). This perpetuates a new demand by the people with said demand being financial freedom. The people want to be able to engage in transactions with others, free of interruptions from central authority, free of the interference from (central) banks and without too much middlemen in between. Furthermore, in the age of internet and automation, why should business hours be limited to local daytime and closed during weekends and on holidays?

3.1. The initial challenge with digital money

The deployment of digital tools in the context of money is nothing new. Examples such as eBay’s subsidiary Billpoint, as well as Citibank‘s c2it, Yahoo!‘s Pay Direct, Google Checkout, and Western Union’s Bid Pay service and PayPal are proof of the potential to use internet as a means to send money to others in a fast and efficient manner. However, there is an important caveat; an often cited benefit of digitalization is the ability to indefinitely copy items without loss of quality. This is great in many contexts, but in the context of money and recording transactions it adds another layer of complexity. After all, how can one verify if assets (verification of assets) are actually there and money has not already been spent (double spending) using digital tools?

PayPal for example uses digital money, but in a manner that is still rooted in traditional banking. In other words, an infrastructure of different transaction information (e.g. a PayPal account that is linked to a VISA account). Thusly, up until 2008, digital money was little more than an extension of the same fiat banking system. Similarly to the traditional banking system, digital money required a vast infrastructure of centralized, private ledgers continuously interacting with one another.

With regards to adopting digital money on a national scale though mobile phone-based payments, Kenya can be considered as the forerunner with the surge of M-Pesa.

Figure 9: M-Pesa, the pioneer in mobile phone-based payments on a national scale.

3.2. The great paradigm shift, from centralized private ledgers to decentralized distributed ledgers.

Early experimentation with peer-to-peer systems such as amongst others the music downloading application Napster inspired the scientific cryptographic community to come up with a radical new way of thinking to solve the problem of double spending and the verification of assets amongst peers; instead of using centralized private ledgers to keep track of transactions, a great deal of trade transactions can in fact take place on decentralized distributed ledgers. This concept was first put forth in the 2008 article ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ by Satoshi Nakamoto, the anonymous creator of Bitcoin. The verification of assets and the controlling for double spending is safeguarded through a shared (distributed) ledger, a concept which has proven to be a very robust.

This paradigm shift from the use of private centralized ledgers to shared distributed ledgers allows amongst others for a decentralized peer-to-peer digital money whilst being able to verify assets and control for double spending. In doing so, the traditional banking system and the controlling financial elite can to a substantial degree be circumvented whilst at the same time empowering the common people by means of facilitating digital, instant, cheap and international payments. The end result is a working form of digital money to facilitate (international) trade.

The principle of distributed ledgers on which Bitcoin is based is revolutionary and invariably forms the basis for a completely new dimension of development and progress for humanity. This fact on itself is reason enough for $PAC to salute and praise Satoshi Nakamoto for communicating this idea to people.

|

Textbox 1: Alternative uses of distributed ledger technology

Note that besides the use of distributed ledger technology for money, many other uses are imaginable. Examples are: partners in supply chain management and notary’s sharing a common ledger. In a different application, DLT can record and track the product life cycle of a single car from raw material producers, car manufactures, car dealers, custom authorities, banks (for loans), insurance companies and authorities (for e.g. speeding tickets). The scope of this article however is limited to the application of DLT as money.

|

4. The first three generations of cryptocurrencies

In this early phase (April, 2018) of distributed ledger technology, which is still at its beginning, we can already distinguish three generations of crypto currencies of which $PAC falls into the third.

4.1. The first generation of cryptocurrencies

The first generation of cryptocurrency’s (i.e. Bitcoin) is characterized by the anonymous leadership, with limited influence on the part of the users. Proof of work (POW) provides an incentive mechanisms for third parties to aid in computing power needed to run the decentralized ledger (mining). Possibly, the anonymous creator of Bitcoin has the ability to suddenly or gradually step forward and substantially influence to the whole Bitcoin market at will.

4.2. The second generation of cryptocurrencies

Second Generation Phase A

The second generation of cryptocurrencies are led by a centralized team of known leaders actively creating networks (e.g. Ethereum & DOGE). In this generation, the concept of deploying ‘Proof of Stake’ (POS) at times in combination with POW is introduced.

Second Generation Phase B:

In the context of this article, DASH is considered to fall within the second generation of

cryptocurrencies. In Phase B of the second generation, POS has evolved to the concept of masternodes, which are in essence ‘high interest savings accounts’, ran on dedicated servers, holding a fixed amount of collateral. For DASH it requires a fixed ‘stake’ of 1000 DASH coins to host a masternode. This is where the derivation of the term proof of stake originates from. To a certain degree, voting rights can influence decision making, but for the most part, the leadership (team) takes the decisions.

With the introduction of masternodes and a voting system, DASH can be seen as the bridge between the centralized teams leading a coin, and (de)centralized teams and its masternode owners voting on big decisions and thus influencing the decisions made by the team and can hence be seen as the bridge between the second and third generation. However, the direct interaction between DASH and its community members is still lacking.

4.3. The third generation of cryptocurrencies ($PAC)

Using the bridge DASH has build, $PAC is pioneering into the phase of community influence on decision making & the management team and thereby realizing the best of both worlds. On the one hand, a professionally dedicated team which focus on the everyday tasks. On the other hand, a large community with people that have an active stake in the organization, can interact with and influence the management directly with feedback and idea’s, culminating in to direct participation in the decision making process by means of voting rights (hereinafter ‘the community of stakeholders’).

In many ways, this concept is similar to that of the Credit Union as discussed in chapter 2.8 of this article. In this context, social media has assumed a critical role in facilitating interactions between people that would otherwise be strangers, dramatically increasing the possibilities for stakeholders to exert their influence. To illustrate: the decision making process behind the operation of Credit Unions usually encompasses the usage of letters by mail with invitations to cast a votes about a particular issue. In the digital age, social media and distributed ledger technology allows for a dynamic decision making procedure, thereby reaping the full benefits of the information age.

It is in this phase that DASH, who was pioneering phase B of the second generation, can be considered a bridge, and $PAC, based on the DASH system, aims to set forth and walk the bridge that DASH has build for us into becoming the first third generation cryptocurrency with a ‘social governance structure’. As a third generation crypto, $PAC aims to have the best of both worlds; a form of leadership together with a community that also has a say in the matter.

5. $PAC as a supremely viable digital currency

In the rapidly developing world of cryptocurrency, $PAC distinguishes itself as a supremely viable digital currency. The information age stimulates the use of combined efforts of the $PAC management together with the community of stakeholders to form a considerable force to deal with both the internal and external environment. This set-up draws upon the collective intelligence of a dedicated community continuously pushing for improving the status quo.

All of this with a complete end-to-end incentive model in place for all entities involved. In doing so, $PAC manages to consistently deliver its value proposition as a generally accepted & trusted means of digital exchange and expand on this. Thusly, in the dynamic world of cryptocurrencies, $PAC is supremely viable as its set up allows for the combined efforts of many great minds towards a commonly shared vision. In many ways, this concept is similar to that of the Credit Union as discussed in chapter 2.8 of this article. For more information in this regard, see the 2018 $PAC coin white paper.

6. Life beyond the exchanges

With the aforementioned taken into account, it is evident that appraising $PAC exclusively by its performance as a ‘store of value’ for speculators belittles the ambition of the coin. $PAC is more than just a currency. Therefore, it is important to consider the life of $PAC beyond the exchanges.

Choice:

The ultimate aim is to manifest $PAC as viable digital currency used as a generally accepted and trusted means of exchange meant for (international) trade. Running at an optimal capacity with more than three thousand dedicated servers and growing, $PAC has one of the fastest networks of all crypto coins, making it the perfect retail currency.

Community

$PAC believes in the potential of the peer-to-peer coins, free from the influence from centralized entities and controlled by the people, much similar to a Credit Union. It is important to check ambition with ambition and thus continuously monitor and safeguard the qualities that make $PAC a unique and workable social governance structure. The features of the third generation of cryptocurrencies ensure that all peers have a common interest in ensuring that $PAC facilitates universal freedom in financial transactions. In addition to this, $PAC is cooperative in nature and will therefore never shy from forming partnerships with third parties if the opportunity merits so.

Content

$PAC aims to have a low threshold for entry of new stakeholders, both in financial and computing power, but also in user friendly-ness and content creation. To this end, $PAC maintains an internal encyclopedia, consultable to any one and for all applicable at all levels of knowledge.

Charity

|

Textbox 2: How will $PAC add value to the international economy?

$PAC aspires to obtain a key (charitable) role in the remittances market. For the most part, this market consists of immigrants working in a foreign country and sending money back to family in the less-developed homeland. A lack of affordable access to formal banking services results in these family members having to physically go by middlemen such as Western Union and Money Gram that assume a substantial transaction fee. $PAC will therefore place itself as a viable substitute product in the international remittances market.

|

The $PAC community of stakeholders holds the view that a portion of the revenue should be allocated to charity programs, picked by the community through various consensus mechanisms. The initial focus of these charity programs are in line with the promotion of broader objectives aspired to by $PAC, namely enhancing: (1) digital savviness, (2) access to internet and (3) access to digital equipment for humanity globally.

7. Conclusion

The aforementioned taken into account we would like to submit to you the view that $PAC holds the future. $PAC meets all the criteria needed to facilitate trade and pricing around the world without the need of letters of promises to pay (fiat money). Without the need of making use of networks that are anonymously owned or otherwise run by central leadership. Instead, we opt for a new system, entailing a broad community of stakeholders. A bright future lays ahead of us, and we would like to invite you to be part of our journey.

■

| Date: |

April 22, 2018 |

| Location: |

Willemstad, Curacao |

| Authors: |

| Dennis Arrindell, MSc. |

Dennis@paccoin.net |

| Robin Matthes – Gi-san#9574 |

Robin@paccoin.net |