Bitcoin is one of those love-hate relationships that seem to elicit equally passionate responses from both sides. Those who most fervently advocate on behalf of Bitcoin generally do so because of its monetary value. Amongst those who invest in or trade cryptocurrencies, Bitcoin is considered by most to be the ‘safest’ or the one most likely to retain its value in the long term.

But, while it might seem to be an odd thing to say about a currency, Bitcoin’s value is only half the story. One of the key differences between cryptocurrencies and fiat currencies is that every cryptocurrency is underpinned by its own implementation of blockchain technology. It is the implementation of the blockchain that determines the unique characteristics of each coin, including the costs of using it. With Bitcoin, these costs are much greater than many people realize.

Fees

Fees are an integral part of Bitcoin. This is one of the more literal interpretations of “the cost of using Bitcoin”, and one of the most obvious. Simply using the Bitcoin network, transferring Bitcoin from an exchange to your wallet, will demonstrate this fundamental aspect.

While these fees are not unjustified or excessive, (especially when you consider that Bitcoin was the first real attempt at producing a cryptocurrency). As time goes on, we are seeing an increase in the number of coins offering lower transaction fees, or none at all in some cases.

However, it isn’t these literal costs of using Bitcoin that are most concerning, it is the hidden costs.

Mining

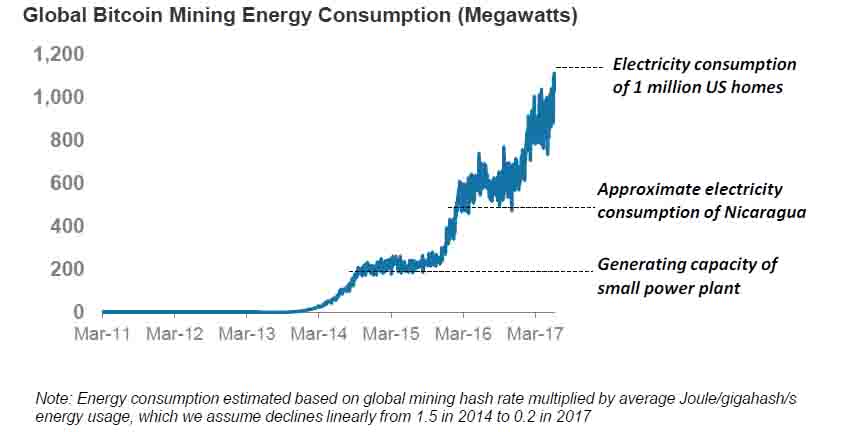

Bitcoin mining is big business. It’s through mining that new Bitcoins are created, and with the value of a single Bitcoin recently spiking above the $8,000 mark, it’s easy to understand why so many people want to get in on it. Every time a new miner joins the Bitcoin network, they are increasing the total amount of power being used to solve hashes and produce blocks.

The Bitcoin network has been designed to add a new block to the blockchain every 10 minutes. This means that when there are more miners, and therefore more power, on the network, it compensates by raising the difficulty. This higher difficulty translates into a higher requirement, both in terms of computing power and electricity.

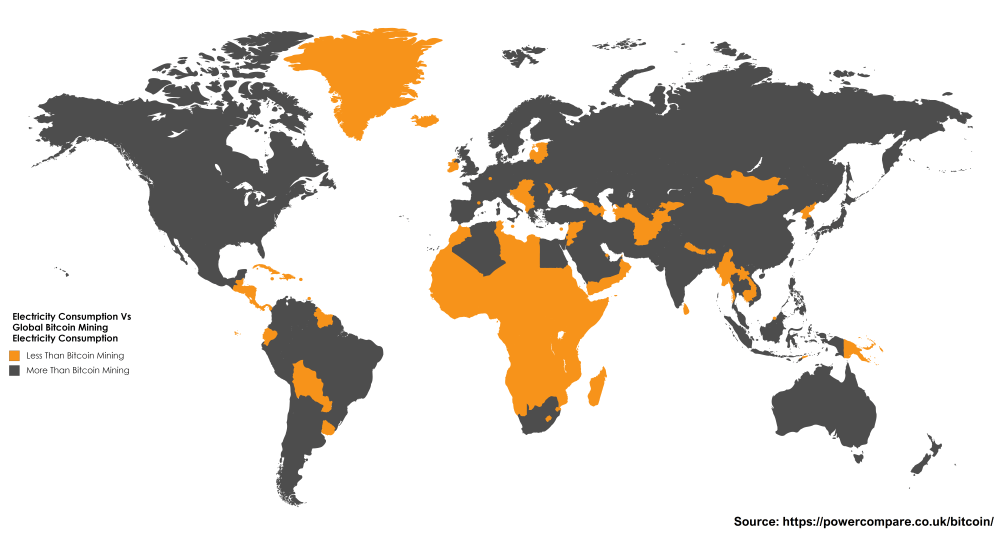

With Bitcoin mining occurring on the scale that it is today, the amount of electricity required to maintain the network is quite substantial. In fact, on an annual basis, it is the equivalent to the amount of electricity used by the entire nation of Ireland.

Centralization

Many of Bitcoin’s strongest proponents speak of it in almost utopian terms. There is no denying that, as a concept, cryptocurrency does offer a tremendous amount of hope and promise for the future. Looking at cryptocurrencies purely in terms of the underlying technology, it is easy to see where these high hopes are coming from. However, in practice, things are a bit more complicated.

The influx of miners joining the Bitcoin network over the last several years has done more than just increase the energy requirements. Because each Bitcoin is now so valuable, and because the spoils of each block are divided amongst all the miners (the pool) who contributed to solving the hash, there is a real incentive for the biggest mining operations to “seize” entire blocks.

Miners are able to join specific blocks, with the block creator taking away the lion’s share of the profits. Mining operations with the most resources at their disposal are able to focus those resources so that they account for a significant portion of individual blocks. This means that these operations are earning far more on average than the average miner. Bitcoin’s decentralization begins to fall apart under these conditions. Currently, somewhere in the region of 80% of all Bitcoin mining occurs in China, and is state-subsidized to some degree. This exacerbates both the environmental impact, and the centralization, of Bitcoin mining.

Alternatives

There are a number of currencies that could handle these issues more elegantly than Bitcoin.

For example, Nano (formerly RaiBlocks) is a lightweight cryptocurrency that offers near-instantaneous, and feeless, transactions. Additionally, there is no mining involved, all the Nano that will ever exist, already exists. Because it is so lightweight, it currently takes 330,000 Nano transactions to use the same amount of power as a single Bitcoin transaction.

There is no denying that Bitcoin is an important and revolutionary technology. However, the future of cryptocurrency could be looking very differently in the future. As time goes by, the issues with Bitcoin are becoming harder and harder to ignore. While Bitcoin remains ‘King’ we have to ask ourselves – ‘Is this as good as it gets?’.

Author Bio:

David Sail:

David Sail is the lead cryptocurrency analyst at MINEABLE.com. Having spent the last 4 years as a professional equities trader, David has turned his sights to cryptocurrencies in early 2017 and is now managing his own website focused on news, guides, crypto mining and price analysis.

Contact: admin@mineable.com

Twitter: https://twitter.com/mineable_