Your project statistics gives you the key of the investor’s behavior and personality. How to see the real people behind figures and graphs? How to use your analytics data to improve your ROI and gain your investor’s trust?

What will you learn:

- Geography: Where to find the most generous investor? The richest countries and cities for ICO.. 2

- Demography: Who is your investor and why do you want to know it? Men risk, women consider. The youngest and the oldest investor 6

- Behavior: How to get more from your marketing and PR activities? How much do investors spend for project? Owls and early birds. “7×7” investor’s journey theory. 8

Hi! My name is Lena and I provide an UX/CX consulting for ICO projects.

Last week I was looking through the statistics of my clients and came up with the idea of sharing my experience with you. I’ve inspected about 3 000 transactions from 117 countries for the last two projects and here is what I understood: the main common trend among those ICO – lack of strong trends.

Though people remain people, every ICO is a unique snowflake. The ICO market is highly unpredictable, because “the main marketer on ICO market is Bitcoin”. While crypto is not stable – you cannot make any accurate forecasts. Your project’s specifics, season and many other factors also affects your success.

That’s why statistics became more important than ever.

Though we cannot plan the whole campaign at once, due to early statistics we can correct our Advertising and PR strategy on the fly. Statistics gives us a ground to develop and implement urgent edits for our website informational architecture and design. For example, when we found China at the top of the ROI countries list for one of our Cyber Security project, we quickly created a totally different local landing page and promo materials for out Chinese investors. New web-page matches specific communicational patterns and visual habits of Chinese audience. New banners look creepy and new Media Plan… it definitely needs a separate story.

Therefore, though statistics cannot give you a hard ground, it may give your ICO campaign ship a fair wind. So watch the metrics, consider stars and may be the following figures of us will help you to rich your treasure island.

1. Geography: Where to find the most generous investor? The richest countries and cities for ICO

You might have no idea where do your investors accumulate. Statistically most blockchain aware and active audience live in US. So if your project is global, it’s worth to start from there. Next step – look carefully on data you gain from your project analytics and correct your targeting.

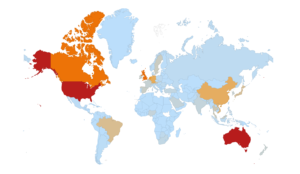

The total investments geography for two projects that we inspected looks like that:

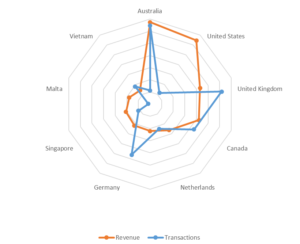

The hottest countries – Australia and US, followed by Canada, UK and Netherlands. Than – China.

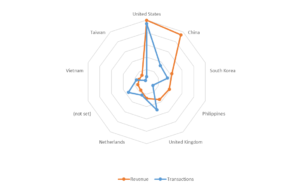

Countries of top-10 for both projects made 70-80% of total investments. However, transactions quantity and amount are not quite match.

As you can see, most valuable countries for two projects are not the same. The cause of such difference might be the time their ICOs happened (December ‘17 – January ‘18 for one and March – May ‘18 for the other).

Projects’ specifics might affect investors’ geography as well. Though both projects develop high technology, the first is more blockchain oriented, and the second one makes an accent on data security. We can assume that Cyber Security is more painful problem for the Eastern hemisphere and consider this in our promo actions.

UPD

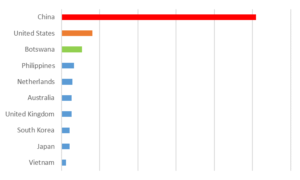

While I was working on this text – some new data on the second project investments’ geography appeared.

China still takes the first position. But because of couple substantial transactions – Botswana suddenly brakes into the top-3. This might be surprisingly, but is actually not. Just because it is a typical situation for ICO projects:

- Individual investors (aka Angels) rule, they may change your statistics (and your whole life) any moment by making a substantial transaction.

- “Word of mouth” can give you a better result than thousand bounties. Imagine, some Botswanan diamond king heard from his Amsterdam distributor about your project. He decided to bring you some 100 BTC, and also told his brother, another Botswanan diamond king does the same. You and your team are happy, but you cannot count conversion acquisition or plan any ad. Pure magic! Unpredictable, beyond any forecast.

We’ll talk more about the magic later. And now let’s go back to our routine. Because with no hard work you’ll unlikely attract any magic.

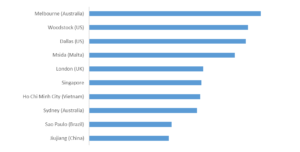

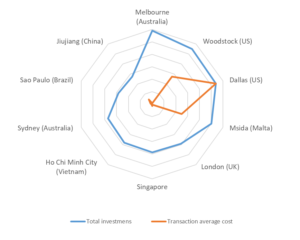

Going deeper in the investments geography, we discovered the “wealthiest” cities for ICO.

Top-10 cities by investments amount bring from 40% to 70% of all raised money. Percent varies depends on project, but it’s still significant. So, for the best ROI you should target your ad more accurate.

Melbourne (Australia), Woodstock (US) and Dallas (US) seem to be the most attractive targets. But be aware – statistics shows only an average figures. To see the real people’s behavior through the data, you need the detailed parameters. In a “city case” we considered also transactions’ average cost.

And what do we have:

Now it’s visual, that Melbourne is not the best option. Though we have lots of activities from there, those transactions are not of high cost. One Melbournian investor acquisition will be higher, than one Msidanian. So, our growth points are: Dallas (US), Woodstock (US) and Msida (Malta). Have you ever been in Malta?

You never know where do your angels live. But once you’ve found it – you know how to improve your marketing ROI.

2.Demography: Who is your investor and why do you want to know it? Men risk, women consider. The youngest and the oldest investor

Now you know where to find your investor. But what will you tell him (or her) once you’ll meet the one? Learn who he is literally, it makes communication much easier.

For the majority of ICO projects, prospective investor is a working man of 25-45.

Let’s look closer at investors for our two ICOs. Who are those guys? Or girls.

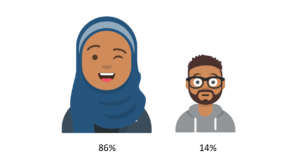

Female investors put in only about 3% of the whole investments average. This share vary a little for different countries. And there are some exceptions, like Qatar, where women made 86% investments, and men only 14%. Still, those are just exceptions.

Guys are more adventurous in their investments. They made more transactions and bravely put their money into high-risk projects, as any ICO is. So talking about investors in general, we mean primarily men.

Guys are more adventurous in their investments. They made more transactions and bravely put their money into high-risk projects, as any ICO is. So talking about investors in general, we mean primarily men.

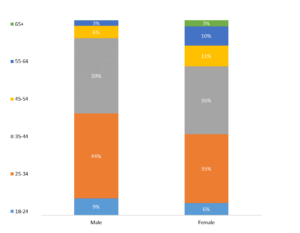

As for age, grownups trend to pay more with one transaction.

Female audience looks much more mature then male. But as women take less share in a whole investments, it usually affects a little on our promotion activities and marketing strategy.

So, the most interesting segment for two of ours ICOs marketing and PR activity – male 25-45. To raise even more investments we can also create a special strategy for 45+ and 25-. That’s actually what we did.

You should consider your project specifics and gain your own demographics data to know who is talking to your ICO marketing communications.

3. Behavior: How to get more from your Marketing and PR activities? How much do the investors spend for the project? Owls or early birds? “7×7” investor’s journey theory

As you know, where and who are you looking for, it’s time for the fine tuning. There is no limits for your marketing strategy and tactics improvements in your project. And as ICO going further, as you learn your investor better, and your investor should know your project deeper. We hope, you don’t seek for the fast money – but for the deep engagement, fair loyalty and long-term partnership with every of your investors. So, you must talk to each of them and look closer at their habits and behavior. And statistics can give you some precious insights.

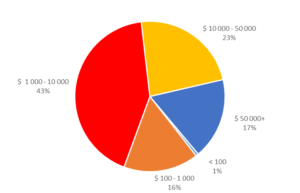

How do investors spend their ICO-money?

Transactions from $1 to $10 thousands make 43% (almost a half) of the whole investments. Two other segments, investors who are ready to place into your project from 10 to 50 grants and more, make another 40%. What does it mean? Investors are serious people. You shouldn’t rely on ten millions 1-token buyers. Checks less than $1 000 took only 16% of whole project investments. At least for those two projects we deal with – it’s not the best decision. To gain serious money you should be serious, make high-quality product and content, professional promo, pure legal part and transparent business-plan. ICO-investments are not easy money, no more. If you have serious intentions, strong idea and trustful team – inhale and go.

To speak to the real people directly try to match the proper time for community engagement activities. Webinars, Q&A sessions and life streams work better in time when your community is the most actively interacts with your project and brand.

For two projects we investigating, activity by hours for UK (just a reminder, different countries have different time zone) looks like that:

Looking at this graph, we can plan online direct communication 9 or 11 AM for the best result.

And for the dessert – couple of words about the magic.

Any statistics never shows you the real human face. To meet the real person you need to talk to him (or her) directly. And the very statistics gives you a key – how, when and where is the best point to do it.

Working a lot & not only with data, charts and interfaces, but also with in-the-flesh investors with different Geography, Demography and Behavior models, we’ve figured out a theory of “7×7” investor’s journey. It tells: it takes 7 touches and 7 days of average serious investor to make a serious purchase (those 17% with 50k+ transactions). Where touches are all kind of investor’s contacts with the project, it’s promo, website, product, team, community, documents, hundreds of questions and tens of test purchases. And then – 10 BTC does drop into your ETH wallet. Or does not.

What does it mean? Any magic needs a hard work. ICO market is unpredictable, uncountable and beyond any forecast. You never know what kind of the BTC rate will be next week. All you can do is work hard on your product, your marketing strategy, explore your audience and meet your investors face-to-face.

Statistically, 2 of 300 ICOs got their Hard Cap and rose project into the Big Thing. Are you ready be involved in this challenge?

If you do – drop us a line and let’s do it.

Lena Stoianova,

UX/CX Designer

Olshansky & Partners